"But Captain Jack will get you high tonight..." Is it just some strange attachment on my part to 1970s-Suburban-Youth-Long-Island-Angst music? Or is "Captain Jack" by far the best thing in music that Billy Joel ever did?

Saturday, January 27, 2007

The shrill Dean Baker asks a question:

Beat the Press: Global Warming is Serious: Why Can't the Post Treat It Seriously?

In a front page article on President Bush's changing statements on climate change, the Post tells readers that he will spend $29 billion on "climate science, aid, and incentives." Is there even a single reader of this sentence, apart from those actually working on climate policy, who has any idea what this commitment means?

For beginners, how about telling readers the time frame for this spending? My understanding is that the $29 billion will be spent over ten years (approximately 0.1 percent of projected spending), but I don't have any clear idea of what this money refers to, so I can't say that for certain. It would also be helpful to know to what extent this money involves an additional commitment of resources -- the government has spent money for decades on climate science and various programs that encourage conservation.

In short, reporting this $29 billion in projected spending provides no information whatsover. Couldn't the two experienced reporters who wrote this piece recognize that they were not providing any information to readers? Couldn't their editors?

--Dean Baker

The Washington Post isn't in the business of providing information, Dean. That would be "unbalanced."

Brilliant at Breakfast:

Brilliant at Breakfast : They also received dead fishes in the Capitol Hill interoffice mail: You Never, Ever, Ever, Ever Disrespct Da Family:

A top GOP staffer says more than 70 senators would oppose the surge if their vote matched their comments in private meetings. "The White House is trying to but they really don't know how to handle this," said a senior GOP aide involved in the talks.

White House officials are pleading with GOP senators to oppose any congressional resolution that specifically condemns Bush's effort to escalate the war effort in coming months, congressional sources said Friday morning. In private conversations, the officials are telling senators that the resolution would demoralize U.S. troops and hurt the GOP politically for years to come. Bush allies are arguing that Republicans will damage their individual political interests as well.

Their logic is that there is no anti-war constituency inside the Republican Party, pointing specifically to Sen. Chuck Hagel, R-Neb., a potential presidential candidate who has opposed the surge but not gained much traction with party activists. "That's a flat argument," the senior aide said. "That does not work."

Friday, January 26, 2007

Brink Lindsey says that I should talk to U.C. Davis's Dan Sumner to learn about the long-run collapse of Newt Gingrich's constructive "Freedom to Farm" initiative...

ARE Department Website: Daniel A. Sumner is the Frank H. Buck, Jr., Professor in the Department of Agricultural and Resource Economics at the University of California, Davis and the Director of the University of California, Agricultural Issues Center. He participates in research, teaching, and directs an outreach program related to public issues facing agriculture. He has published broadly in academic journals, books, and industry outlets. His research and writing focuses particularly on the consequences of farm and trade policy on agriculture and the economy.

In 1995, he was honored by the American Agricultural Economics Association for his agricultural policy contributions. In 1996 he and co-authors won the AAEA award for Quality of Research Contribution, and his book series related to national farm policy reform was awarded an Honorable Mention for Quality of Communication.

Prior to beginning his current position in January 1993, Sumner was the Assistant Secretary for Economics at the United States Department of Agriculture where he was involved in policy formulation and analysis on the whole range of topics facing agriculture and rural America -- from food and farm programs to trade, resources, and rural development. In his role as supervisor of Agriculture's economics and statistics agencies, Sumner was also responsible for data collection, outlook and economic research.

From 1978 to 1992 Sumner was a Professor in the Division of Economics and Business at North Carolina State University. He spent much of the period after 1986 on leave for government service in Washington, D.C. During 1987-88 he was a Senior Economist at the President's Council of Economic Advisers and was Deputy Assistant Secretary at the USDA from 1990-92.

Sumner was raised on a fruit farm in Suisun Valley, California and was active in 4-H and FFA activities as a youth. He received a bachelors degree in agricultural management from California Polytechnic State University in San Luis Obispo in 1971, a masters degree from Michigan State in 1973, and a Ph.D. in economics from the University of Chicago in 1978.

Thursday, January 25, 2007

The Economist's Lexington correspondent is finally shrill! It writes a good article about Condi Rice.

It's at least four years too late for such an article to be useful and informative, however:

Economist.com | Articles by Subject | Lexington: [Condi Rice's] fingerprints are on some of the worst mistakes of the first Bush term. She claimed the White House was unaware of the CIA's doubts about whether Saddam Hussein had tried to buy yellowcake uranium in Niger, for example, despite the fact that her office had received two memos on the subject and a call from the CIA director. But her culpability is deeper than that. When Ms Rice ran the National Security Council (NSC), it was hopelessly dysfunctional....

Ms Rice has also proved a disappointing manager of the State Department....

Ms Rice made her career by impressing powerful establishment figures.... But what happens when your patrons disagree?... [Rice] chose to flatter her current patron.... [She]... started her career... sceptical about nation-building and democratisation. She might have chosen to restrain her boss's Manichaean instincts with a dose of that realism. Instead she went along with him. Being a perfect protégée can get one a long way up the greasy pole...

I pay for the *Economist* in the hope that it can tell me true things about the world that I don't already know, rather than confirm things that I learned from other sources four years ago.

Dana Milbank writes:

Dana Milbank - In Ex-Aide's Testimony, A Spin Through VP's PR - washingtonpost.com: Memo to Tim Russert: Dick Cheney thinks he controls you.

This delicious morsel about the "Meet the Press" host and the vice president... Cathie Martin... on the courtroom computer screens were her notes from 2004 about how Cheney could respond to allegations that the Bush administration had played fast and loose with evidence of Iraq's nuclear ambitions. Option 1: "MTP-VP," she wrote, then listed the pros and cons of a vice presidential appearance on the Sunday show. Under "pro," she wrote: "control message."

"I suggested we put the vice president on 'Meet the Press,' which was a tactic we often used," Martin testified. "It's our best format."

It is unclear whether the first week of the trial will help or hurt Libby or the administration. But the trial has already pulled back the curtain on the White House's PR techniques and confirmed some of the darkest suspicions of the reporters upon whom they are used.

Dana gets two things wrong in these four paragraphs. First, Cheney doesn't "think" he controls Russert: Cheney does control Russert. Cheney's press aide Cathie Martin is correct when she says that Russert will not push Cheney or attempt to closely question him.

Second, the trial does not confirm "some of the darkest suspicions of the reporters." The reporters have no suspicions about how they are used by the Republican leadership. They have been active coconspirators here. The trial confirms some of the darkest suspicions about the reporters.

These two weasel-words by Milbank--"thinks" instead of "does" and "of" instead of "about"--are markers of the extent to which the Washington press corps is still, after everything, in the tank for and shading its reporting in favor of the Bush administration.

Milbank goes on, calling things "[newly] confirmed... suspicions" that he has known--and I have known--to be facts since at least mid-2001:

Relatively junior White House aides run roughshod over members of the president's Cabinet. Bush aides charged with speaking to the public and the media are kept out of the loop on some of the most important issues. And bad news is dumped before the weekend for the sole purpose of burying it.... She walked the jurors through how the White House coddles friendly writers and freezes out others....

[Martin] proposed "leak to Sanger-Pincus-newsmags. Sit down and give to him." This meant that the "no-leak" White House would give the story to the New York Times' David Sanger, The Washington Post's Walter Pincus, or Time or Newsweek...

Why oh why can't we have a better press corps?

Lance Knobel writes:

: I went to an interesting unconference on talent today at Electronic Arts. I was involved in a discussion on "the big pipe": the need to reform the US education system so the country can have the talent necessary to thrive in the coming decades. One point we agreed on was the need for companies both to understand and lobby about the importance of education.

An executive from Starbucks made the excellent point that CEOs have a limited bandwidth for issues. For many, healthcare looms far larger than education. After all, she said, Starbucks spends more annually on employee healthcare than on purchasing coffee

Dymaxion World enters the Star Trek canon discussion:

Dymaxion World: Nerd moment: For my money, Star Trek VI is by far the best movie the series has produced, ever. Aside from being by far the superior script and directing of all the movies, I'm not sure how you can possibly top the multi-layered Cold War references. Most especially Christopher Plummer as a Klingon channeling Adlai Stevenson yelling to Kirk, "Don't wait for the translation, answer me now!"You could put that movie on every Sunday on Space, and I'd watch it every Sunday.

Honorable mention: Chekov in Star Trek IV, asking in faux-Russian accent "where are the nuclear wessels" to passersby in Reagan-drenched America. Yes...

I prefer this exchange from Star Trek VI: "We believe in alienable human rights!" "Inalienable.* I wish you could hear yourselves. Human rights. The Federation is a homo sapiens only club..."

I must disagree, however, with his claim that Star Trek VI: The Undiscovered Country is the best. There are two better Star Trek movies:

The Weekly Not-Me: Back in 1972, my middle school Social Studies teacher Peter Cohen introduced me to the concept of the weekly political magazine. Ever since then, I have wanted to own one. Now I realize that, with the coming of the web, I can--in an RSS-fueled, rotisserie league sense, that is.

Presenting:

Egregious Moderation: For people who want one online source for punchy liberal political analysis and evisceration; especially evisceration.

I'll form it out of a batting order of twelve (which I will change from time to time), plus occasional guest stars: the twelve people who I would most wish to have on a weekly political magazine's staff, plus the most interesting outside pieces that I would wish to have solicited.

And if you are looking for a real magazine/website meeting a real payroll? I think the American Prospect http://www.prospect.org/ is currently the best, with the New York Review of Books http://nybooks.org/ a close second...

This Morning's Additions to the Pile:

- Daniel Altman (2007), Connected: 24 Hours in the Global Economy (New York: Farrar Straus and Giroux: 0374135320): http://amazon.com/exec/obidos/asin/0374135320/braddelong00.

- Charles Francis Adams (1878), Railroads: Their Origins and Problems (New York: Cosimo Books: 1596054638): http://amazon.com/exec/obidos/asin/1596054638/braddelong00.

- Cosimo Books: http://cosimobooks.com/.

- Charles Stross (2007) Missile Gap (Subterranean Books): http://amazon.com/exec/obidos/asin/1596060581/braddelong00.

- David Edgerton (2006), The Shock of the Old: Technology and Global History since 1900 http://www.amazon.com/exec/obidos/asin/0195322835/braddelong00.

- Paul Starr (2007), Freedom's Power: The True Force of Liberalism http://www.amazon.com/exec/obidos/ASIN/046508186X/braddelong00.

And next Monday I have to be three places at lunch: a seminar by Jesse Fried on "CEO Pay without Performance" at the Labor Relations Institute; lunch with the job candidate Emi Nakamura; and lunch with the economic history seminar speaker Greg Clark...

And I am told that I really need to read another CBO report from 2004 before I start opining about health care program administration...

Cloning. Multiple cloning of myself followed by rapid forced-growth and education by subliminal tape. That is the only possible answer.

Long-Run Healh Care Cost Drivers: One of our best graduate students here at Berkeley--Marit Rehavi--just came by with a truly depressing thought. No matter which subtribe of economists you think is correct in the intellectual health-care wars, the world is moving in directions that make the favored policies of both factions less likely to work in the future.

On health care issues, you see, economists divide into two subtribes depending on whether they think the big problem with America's health system today is adverse selection or moral hazard--two terms from the insurance industry.

Those economists on the left tend to think that the real big problem with American health care is adverse selection: Those who know they are healthy and likely to stay that way skimp on purchasing insurance. Insurance companies work like dogs to avoid selling insurance to people who are expensively sick or likely to get expensively sick. As a result, a huge amount of people's work-time and information technology processing power are wasted on the negative-sum game of trying to pass the hot potato of paying for the care of the sick to somebody else. The more people separate themselves or are separated into smaller and smaller pools with calculably different exposures to risk, the worse this problem gets. The way to solve it is to shove people into pools as big as possible. Ultimately, this line of thought goes, single-payer national health insurance is the best option, for the administrative and bureaucratic inefficiencies introduced are vastly outweighed by the reduction in the gaming the system that goes on under our current plan where profits are made by those insurance companies that are best able to avoid covering the sick.

Those economists on the right tend to think that the real big problem with American health care is moral hazard: that patients soak up scarce and valuable doctor and nurse time even when there is no benefit to the visit, and that doctors use up vast resources conducting tests and procedures that do patients very little good. And, this side argues, patients do this because their copays don't penalize them enough for wasting health professionals' time and doctors do this because their bottom lines don't suffer when they carry out barely effective, expensive, and inappropriate procedures. Sometimes economists on this side say these market failures are all the government's fault: the subsidy the government provides for low-deductible and first-dollar insurance. Sometimes economists on this side say that these market failures arise because of human irrationality: we half-intelligent jumped-up East African Plains Apes have a psychological propensity to overvalue certainty and thus to pay much more for first-dollar and low-deductible health insurance than we should.

The prescription of the right-wing subtribe of economists is to create hard incentives: regulate the insurance market so that the only policies allowable are high-deductible and fixed-reimbursement polices that make doctors feel in their purses the costs of the procedures they recommend, and that make patients feel in their purses the costs of the health professionals' time that they pointlessly soak up. Let insurance companies segment their market so that patients who make unhealthy lifestyle choices--who smoke, who get fat, who drink enough to pickle their livers, who give themselves diabetes by drinking Pepsi--feel the costs of those lifestyle choices in their insurance premiums. If the right-wing diagnosis is correct, this prescription would do a lot of good, because the gains from curbing moral hazard would be much bigger than the side-effects: dry mouth and additional adverse selection. But if the right-wing economists are wrong, this prescription is destructive. It means that those who have already drawn the big black X in life's lottery--those likely to die early and painfully of some dread disease--find their bad luck amplified by the workings of the health insurance market: not only do they die early and painfully, they die poor leaving their children poor as well.

The prescription of the left-wing subtribe of economists is nearly the opposite: it is to soften incentives as a side effect of eliminating opportunities for moral hazard by recognizing that the market for health care financing simply does not work very well, and cannot be made to work very well. If the left-wing diagnosis is correct, the prescription would do a lot of good. Nobody likes going to the doctor or undergoing invasive and usually painful costly medical procedures. The gain by eliminating adverse selection would be much bigger than the side-effects: frequent urination and a small amount of additional moral hazard. But if the left-wing economists are wrong, this prescription is destructive. Health care spending growth will accelerate as the few curbs on doing-everything-for-everybody drop away, and eventually a single-payer government with a budget constraint steps in to ration health care and to ration it badly and destructively, providing the wrong care to the wrong people.

Given these sharp disagreements between very smart, public-spirited, and hard-working economist like Uwe Reinhardt and Jon Gruber on the left hand and Kate Baicker and Mark McClellan on the other, one might despair. One would be further tempted to despair when one remembers that these issues will not be settled by locking Uwe, John, Kate, and Mark in a room until they reach agreement but by 535 legislators who are best described as a ping-pong ball, with the pharmaceutical and the doctor lobbies as the paddles.

And now Marit Rehavi comes by with an additional reason to despair. For according to her reading, as America ages and as American society changes an increasing share of the increase in health care costs is going to be driven not by increases in adverse selection by insurers or by moral hazard driven by doctors ordering inappropriate and barely effective care, but by expensive chronic diseases and risk factors driven by long-term lifestyle choices. Nationalizing the health insurance sector won't diminish the costs in 2050 of treating the lung cancer that the twenty year-old staring smoking today will develop. Increasing copays won't reduce the costs of treating the diabetes that the five year-old today with a two-coke and three-twinkie-a-day habit will develop in 2045.

Neither prescription will be very effective as a remedy to cost drivers like these. Our irresistible force is our belief that health care should not be rationed by price. Our immovable object is the unwillingness of American taxpayers to be turned into an IV drip bag for the health sector that the health sector itself controls. What happens when these meet is a crisis, which cannot be averted no matter whether we adopt the right-wing prescription, adopt the left-wing prescription, or muddle through.

Is there a magic bullet to reduce these chronic-diseases-of-aging-life-style-driven sources of secularly rising health care costs? I can see only one chance: the nanny state. Lectures every half hour, on every TV channel, by the surgeon general and the assembled celebrities of America, telling us to: lose weight, exercise more, don't smoke, don't drink to excess, watch your fats, watch your sugars, eat your vegetables, et cetera--remember that you are an East African Plains Ape that did not evolve to live in a world where fats and carbohydrates were abundant and smoke damaging to your lungs was laced with nicotine.

Another reason to like Barack Obama:

Horses Mouth January 24, 2007 12:41 PM: OBAMA TAKES ON FOX NEWS. If this is a sign of how Barack Obama intends to deal with the right-wing media during his Presidential campaign, then I'm all for it.... The Senator's office has just emailed out... the following:

In the past week, many of you have read a now thoroughly-debunked story by Insight Magazine, owned by the Washington Times, which cites unnamed sources close to a political campaign that claim Senator Obama was enrolled for "at least four years" in an Indonesian "Madrassa"... "espousing Wahhabism," a form of radical Islam.

Insight Magazine published these allegations without a single named source, and without doing any independent reporting to confirm or deny the allegations. Fox News quickly parroted the charges.... All of the claims about Senator Obama raised in the Insight Magazine piece were thoroughly debunked by CNN.... If Doocy or the staff at Fox and Friends had taken [time] to check their facts, or simply made a call to his office, they would have learned that Senator Obama was not educated in a Madrassa, was not raised as a Muslim, and was not raised by his father -- an atheist Obama met once in his life before he died.

Later in the day, Fox News host John Gibson again discussed the Insight Magazine story without any attempt to independently confirm the charges....

These malicious, irresponsible charges are precisely the kind of politics the American people have grown tired of, and that Senator Obama is trying to change by focusing on bringing people together to solve our common problems.

This is exactly the right thing to do: Take these guys on very aggressively, and above all, single out by name the people who are lying about you. Wrap their lies around their necks.

Steven Kyle on Tyler Cowen on inequality:

Angry Bear: Tyler Cowen Makes Two Mistakes: Tyler Cowen says that rising inequality in the US isn's as bad as we think it is and also that insofar as it does exist we shouldn't worry about it. He makes two mistakes:

He says that because much of measured inequality in incomes can be traced to differences in education, it isnt a result of policy or of basic unfairness in the system. This would be true if there were a level playing field in terms of education in the first place. However, there very obviously isnt.... Bottom line %u2013 If the deck is stacked against poor people in terms of educational opportunity then we can't say that tracing income inequality to education shows that "the contemporary American economy isn't rigged in favor of the rich," to use Tyler Cowen's terminology.

Cowen goes on to say: "The broader philosophical question is why we should worry about inequality -- of any kind -- much at all. Life is not a race against fellow human beings, and we should discourage people from treating it as such. Many of the rich have made the mistake of viewing their lives as a game of relative status. So why should economists promote this same zero-sum worldview? Yes, there are corporate scandals, but it remains the case that most American wealth today is produced rather than taken from other people. What matters most is how well people are doing in absolute terms."

To this, I can only say that it takes a white middle aged economics professor with tenure to come up with a statement like that.... [I]n the real world [inequality] makes people distrustful of the system and causes them to lose faith in the fairness of society. General belief in the social contract is a long term asset to us all and one we should be very worried about losing. Only a very narrow view of the world could conclude otherwise...

Amanda Marcotte confesses: American Thai food is really a way for adults to eat peanut butter without shame:

Food, fear, meandering commentary at Pandagon: I make an awesome Pad Thai. I don't make it with peanut oil. I use... peanut butter. If you use peanut oil like you're supposed to, for some reason it doesn't taste as peanut-y as it should.... Most people like the way I make it, but mentioning this in a public forum brings upon me the cringe of shame....

The reason I bring this up is because I was all excited about this interview in Salon with Barry Glassner about some of the fear and morality issues that have cropped up on food politics and why they skew people's priorities.... I wanted to see what Glassner would say about the search of authenticity in food, because I think in a lot of ways such a search is both doomed and can be intimidating to people who are learning to cook.

Why oh why can't we have a better press corps?

Markos Moulitsas Zuniga, a member of the board of Working for Us, says:

This is a potent alliance, and one that will have real muscle as we look to target not "conservative" Democrats, but Democrats who are out of step with their districts (a key and important distinction). This is no lame-brained Club for Growth clone -- an operation obsessed with ideological purity without regard to electoral realities...

And Chris Cillizza of the Washington Post says:

They (Better) Work For Us - The Fix: Working For Us... carries the backing of people like Steve Rosenthal, a past political director at the AFL-CIO, Tom Matzzie, the Washington director of Moveon.org and -- most intriguingly -- blogger icon Markos Moulitsas Zuniga, founder of the influential Daily Kos Web site. Working For Us is modeled explicitly on the Club For Growth, an independent organization that over the last several election cycles has transformed itself into an electoral force by endorsing fiscally conservative candidates in contested primaries and then pouring hundreds of thousands of dollars into districts to help those candidates win. (I've written extensively about the Club both in the space and elsewhere)...

Ummm... If a board member says that it's "no lame-brained Club for Growth clone" isn't that worth mentioning?

Andrew Samwick, Paul Krugman, Pecuniary Externalities in Health Prices, and Local Monopoly Power Created by Plans that Let You Choose Your Own Doctor.

Andrew Samwick on pecuniary externalities:

Vox Baby: Pecuniary Externalities: For what it's worth, I think Paul Krugman makes some good points about the problems inherent in using the tax code to encourage or discourage the purchase of health insurance in his column.... However, I found this statement (highlighted in bold) in Krugman's column to be odd:

Mr. Bush.... The tax code, he said, "unwisely encourages workers to choose overly expensive, gold-plated plans. The result is that insurance premiums rise, and many Americans cannot afford the coverage they need."... No economic analysis I'm aware of says that when Peter chooses a good health plan, he raises Paul's premiums. And look at the condescension. Will all those who think they have "gold plated" health coverage please raise their hands?...

Andrew says:

That is almost the definition of a pecuniary externality. Wikipedia describes it as follows:

A pecuniary externality is an externality which operates through prices rather than through real resource effects. For example, an influx of city-dwellers buying second homes in a rural area can drive up house prices, making it difficult for young people in the area to get onto the property ladder. This is in contrast with real externalities which have a direct resource effect on a third party. For example, pollution from a factory directly harms the environment. Both pecuniary and real externalities can be either positive or negative.

So in the President's defense, there's a very simple argument to be made here. When one person feels inclined, for whatever reason, to purchase more health care services, that puts upward pressure on the price of health care services (if the supply curve is not flat) and thus the cost to everyone else in the market. Normally, we don't pay any attention to this, because that is precisely the mechanism by which a competitive market achieves economic efficiency.

The President is referring to the pecuniary externality generated by a tax distortion in the treatment of health insurance, which interferes with a market achieiving economic efficiency and thus should concern us. It goes as follows. Premiums are fully excludable from income tax, but out-of-pocket expenses are not tax advantaged. That favors health insurance arrangements in which there are low deductibles and high premiums. Such arrangements can lead to higher utilization of health services, since the insured faces no financial cost at the margin once the low deductible has been met. (This is just a standard moral hazard argument.) Krugman... [is] on shaky ground with his "Wow ... no economic analysis ..." comment.

I think Paul Krugman would say that he believes that health care is a constant-returns-to-scale industry, and that the subsidy provided by the tax code-driven increase in demand and spending increases quantities demanded but not prices in the long run. The supply curve, Paul Krugman thinks, is flat in the long run, and so Andrew Samwick's pecuniary externality argument fail.

It's not clear to me that Paul Krugman is wrong. It is also not clear to me that Paul Krugman is right. One of the things patients are buying with more expensive health-care plans is the freedom to choose their own doctors, and that gives the doctors they choose some monopoly power in their bargaining over reimbursement rates with the insurance companies.

I don't have a handle on how big this effect might be, however.

Mark Thoma directs us to Greg Ip, Kara Scannell, and Deborah Solomon writing on Wall Street's share of world finance:

Economist's View: Capital Markets Regulation: Greg Ip, Kara Scannell, and Deborah Solomon of the Wall Street Journal look into claims that regulations such as Sarbanes-Oxley are reducing the competitiveness of U.S. financial markets. They find reasons to be skeptical:

In Call to Deregulate Business, a Global Twist, by Greg Ip, Kara Scannell, and Deborah Solomon, Wall Street Journal: Prominent figures in the U.S. are warning that the nation's financial markets have been handicapped by post-Enron regulatory overreach. Treasury Secretary Henry Paulson has made addressing the problem a signature political issue. A blue-ribbon committee chaired by former Bush economist Glenn Hubbard has echoed this sentiment, as does a report commissioned by Sen. Charles Schumer of New York and New York City Mayor Michael Bloomberg.... Their solution: a lighter touch in regulating corporate behavior.

Yet this position, which has gone largely unchallenged, downplays a different explanation for why U.S. exchanges are under pressure -- the changing nature of global finance. Stock markets around the world have become better and deeper, encouraging companies to seek IPOs in their home market. Trading across borders has become simpler, cutting the prestige and usefulness of a big-country listing everywhere.... Meanwhile, other countries are stiffening their own rules, bringing them closer to the U.S. model....

Hubbard's Committee on Capital Markets Regulation... spent 148 pages discussing the harm done by U.S. regulatory and legal risks. Among the charges: Suing corporations for fraud is too easy... Civil and criminal prosecutors are overzealous, producing civil enforcement penalties more than 100 times higher in the U.S. than the U.K. in 2004. Auditing standards are unreasonably onerous for small companies....

Hubbard concedes there's "no smoking gun" that proves whether global or U.S.-specific forces are behind the smaller number of foreign companies listing in the U.S. "Both factors are important," he says....

There's little doubt U.S. exchanges are facing increasing competition. They're losing out to overseas exchanges for initial public offerings. Many overseas companies are deciding they don't need an American listing. And in the U.S. itself, many companies have decided they're better off private.

Taken alone, the cost of regulation can't explain what's happening to U.S. financial markets.... "Well-functioning capital markets are central to the success of the economy," says former Treasury Secretary Lawrence Summers, now a Harvard University economist and managing director at a hedge fund. "What fraction of capital markets transactions runs through New York is of much less broad-based significance"...

Wednesday, January 24, 2007

Econ 210a: Jan. 24. The First Age of Globalization [Eichengreen DeLong]

I'm filling in for Barry Eichengreen: he has the flu.

Jan. 24. The First Age of Globalization [

EichengreenDeLong]Albert Fishlow (1985), "Lessons from the Past: Capital Markets During the 19th Century and the Interwar Period," International Organization 39, pp. 383-439, http://www.jstor.org/view/00208183/dm980251/98p00792/0

Douglas Irwin (1998), "Did Late Nineteen Century U.S. Tariffs Promote Infant Industries? Evidence from the Tinplate Industry," NBER Working paper no. 6835 (December), http://www.nber.org/papers/w6835

Arthur Bloomfield (1959), Monetary Policy Under the International Gold Standard, New York: Federal Reserve Bank of New York, selections, on reserve at Haas.

Hugh Rockoff (1983), "Some Evidence on the Real Price of Gold, Its Costs of Production, and Commodity Prices," in Michael Bordo and Anna Schwartz (eds), A Retrospective on the Classical Gold Standard, Chicago: University of Chicago Press, pp. 613-651, on reserve at Haas.

Questions:

Textbooks say that the gold standard had internal mechanisms that worked automatically to maintain both price and balance-of-payments stability. On what grounds do Arthur Bloomfield and Hugh Rockoff challenge this textbook view? Are their points convincing?

Thoughts:

The infant-industry argument. Even John Stuart Mill admitted the power and force of the infant-industry argument. Doug Irwin takes it on. How convincing do you find his argument?

Are there any truly important differences between late-nineteenth century capital markets and capital markets today. If so, what are the truly important differences?

The classical gold standard in theory and history

- Did it work?

- How did it work in the core?

- How did it work in the periphery?

- The "rules of the game"--violated

- What did central banks do?

- Stabilized bond prices

- Mirrored the Bank of England

- What did the Bank of England do?

- Avoided gold losses...

- ???

Paul Krugman has it largely right on Bush health care, I think:

Additional Notes on 1/22 Column, "Gold-Plated Indifference." - Krugman - NYT Web Journal: Additional Notes on 1/22 Column, "Gold-Plated Indifference." As is often the case, I couldn't fully explain my views in the space available. So I'd like to explain at a bit more length why I'm so opposed to the direction Bush is going.

Basically, everyone agrees that health care is a messed-up sector. But there are two opposing doctrines about what the problem is.

I believe -- and the evidence, I think, supports this belief -- that the big problem is "adverse selection." An insurance plan offered to everyone at the same rate would be a great deal for relatively sick people, a poor deal for the healthy. So one of two things happens to private insurance. Either plans go into the "adverse selection death spiral," as sick people flock in, driving up rates, driving out more healthy people, and so on. Or insurance companies spend a lot of the money they receive in premiums screening out "high-risk" clients, so that the system has huge overhead and the neediest cases are excluded.

The clean solution to this problem is for the government to provide insurance to everyone. Other rich countries do that. So do we, for older Americans, veterans, and others. Actually, government health insurance is already bigger in America, in dollar terms, than private insurance -- it covers fewer people, but that's because the elderly, who cost more, are handled by the government.

Employment-based insurance is a distant second-best, but better than nothing. Large employers, in particular, can spread risk widely, creating the kind of risk pool that dies from adverse selection in the individual market. And the tax preference for employer-based care, more or less by accident, has helped sustain this imperfect fix....

What conservatives in the "consumer-directed" health movement believe, however, is that the big problem is "moral hazard" -- people consume too much medical care, because someone else pays for it. Now, this isn't entirely wrong. People probably do undergo expensive surgery with questionable effectiveness, and so on, because it's not out of pocket. Curbing that was supposed to be the point of managed care. But managed care didn't deliver, because people -- rightly -- don't trust private H.M.O.'s to make life and death decisions on their behalf....

The whole consumer-directed thing is, in my view, just at attempt to avoid facing up to that failure. Rather than admit that private-sector institutions aren't any good at rationing, conservatives now say that patients should be induced to ration their own care by being forced to pay more out of pocket....

The trouble is that the big money is in stuff like heart operations or other areas where (a) people can't pay out of pocket in any case -- they must have insurance or go untreated -- and (b) people really aren't sufficiently well informed to make the decisions. Yet the whole focus of consumer-directed doctrine is on things like routine visits to doctors' offices and annual dental checkups. It's going where the money isn't -- because the advocates just can't believe that markets aren't always the answer.

Now here's the thing: in the name of consumer-directed health care theory, Bush is proposing changes that would essentially encourage people to move into the individual market -- which wastes a lot of money, and doesn't and can't work for those most in need -- while undermining the employer-based system, which isn't wonderful but is still essential. In particular, healthy high-income people would be encouraged to drop out of employment-based plans, leaving behind a sicker risk pool, driving up rates, and pushing employer-based care in the direction of an adverse selection death spiral. The plan we're supposed to learn about tomorrow doesn't sound big enough to have catastrophic effects, but it's a step in the wrong direction.

Hoisted from Comments: The Dawn of Humanity

Grasping Reality with Both Hands: Brad DeLong's Semi-Daily Journal: The Dawn of Humanity: What astonishes me is the speed. They've got the origin date at -56,000, and the oldest modern human remains in Australia are -40,000. The route from East Africa across Asia to Northern Australia is 10K+ miles, which means humans were expanding at close to a mile a year. That's just unbelievably fast.

We have all sorts of branches of homo surviving stably for a million plus years all over africa, asia, and europe, and this new branch comes out of Africa and by the end of the Great Migration, only a little over ten thousand years later, they are building boats to sail to Australia. And wiping out or out-competing every one of our homo sibling species on the way.

The Singularity is truly in our past.

Posted by: tavella | January 23, 2007 at 05:15 PM

I think he gets it almost right:

Steven Pearlstein - Bipartisan Cooperation on Health Care Is Dead on Arrival - washingtonpost.com: When it comes to domestic economic policy, Bush the Wounded President is much to be preferred over Bush the Decider. After six years of stubborn inflexibility, President Bush signaled last night in his State of the Union address that he is ready to come to the negotiating table on a range of domestic issues, holding some new and credible ideas that are consistent with his conservative philosophy but open to ideas that aren't.

[I]t is possible it could be a bluff, a desperate and hollow attempt by an unpopular president to demonstrate that he's still relevant to the policy process. But whether it is or not, the right response for Democrats is to call that bluff, treating it as the jumping-off point for a much-delayed dialogue on domestic policy and seeing how his proposals can be transformed into something better....

The president's health plan would, in fact, put a cap on a $200 billion-a-year tax break that now goes disproportionately to those with the most generous and costly employer-provided health insurance plans. It would redirect a small portion of that break to those who have less generous coverage or those who have to buy their own insurance.... Now is this the magic bullet that will solve the health-care crisis? Of course not. Would any real solution also require finding billions of dollars more to subsidize the purchase of health insurance by low-income workers and getting states to reform dysfunctional markets for individual and small group insurance? No doubt about it....

But anyone seriously interested in health reform would welcome the president's proposal as a basis for negotiations, raising public expectations and increasing pressure on the president to embrace more comprehensive reform...

Where I disagree with Steve is that I believe it is overwhelmingly likely that this is, in fact, a bluff. And it is not clear to me why anybody should be in the business of welcoming things that are not "real solutions."

We should certainly welcome real solutions. But otherwise it seems to me that we are still in the standard Bush administration game of Dingbut Kabuki. The administration has made no effort to convince us that this will do more good in terms of redistributing income and increasing access to health insurance than it will do harm in magnifying adverse selection problems.

It's really unfair. In a just world, the journamalistic Washington Post would be sending me checks for reading it.

Today, in the left-hamd ring, we have Ruth Marcus performing the triple Democratic-trashing somersault.

She says that the Bush health proposals are bad:

Ruth Marcus - The Knee-Jerk Opposition - washingtonpost.com: Yes, there are big risks involved, primarily that the already-teetering employer-based system will collapse as healthy individuals use their tax deduction to buy cheaper, private insurance, leaving employers with the older and the sicker. And, yes, it's fair to argue that a more comprehensive approach -- Sen. Ron Wyden (D-Ore.) has proposed one -- is needed...

She says that it would be insane for all of the reality-based not to presuppose that everything Bush proposes is going to be bad:

This sad situation is largely of Bush's own making. He is reaping the poisonous state of affairs that he helped sow for six years. So many of the president's policies have been dishonest and wrongheaded, so much of his politics has been slashingly partisan, Democrats would be crazy if their instinctive reaction to a Bush plan for fill-in-the-blank wasn't intense distrust...

But still she manages to say that the Democrats shouldn't be pointing out that the Bush plan doesn't look like good health policy:

Listening to Democratic reaction to Bush's new health insurance proposal, you get the sense that if Bush picked a plank right out of the Democratic platform -- if he introduced Hillarycare itself -- and stuck it in his State of the Union address, Democrats would churn out press releases denouncing it.... Democrats -- if they care more about addressing health-care needs than scoring political points -- ought to be finding ways to improve and build on the Bush proposal, not condemning and mischaracterizing it. Given that nothing's going to pass without Democratic approval, what's the risk in engaging in the discussion?

Marcus ignores not only that the Bush health proposals are not good policy, but also that the Democrats are engaging in the discussion. As she herself writes, "Sen. Ron Wyden (D-Ore.) has proposed" a more comprehensive plan, and "it's fair to argue" that such a more comprehensive approach "is needed."

And, of course, Ruth Marcus hasn't done her homework. She doesn't understand the Bush proposals. An example: She copies a Republican talking point:

The deduction would... [leave] 80 percent of those with employer-sponsored coverage unaffected.

The deduction would indeed worsen the finances of only 20% of those with employer-sponsored coverage in 2009. But it would worsen the finances of about 50% of those with employer-sponsored coverage in 2019. And 90% of those with employer-sponsored coverage by 2030.

Why oh why can't we have Washington Post writers who do their homework? Or don't write about things when they haven't done their homework?

The Washington Post would have better served its readers if it had simply printed blank space where Ruth Marcus's column is, save for a link to Len Burman, Jason Furman, and Roberton Williams, "The President’s Health Insurance Proposal-—A First Look" (Washington DC: Tax Policy Center) http://www.urban.org/UploadedPDF/411412_firstlook.pdf.

Tuesday, January 23, 2007

Why Republicans Say "Democrat Party" Rather than "Democratic Party": Because Joe McCarthy Did So. WSJ Washington Wire explains all:

Washington Wire - WSJ.com: From the President, a Two-Letter Jab at the Democrats: President Bush departed from the prepared text of his State of the Union address to... take a jab at Pelosi and the rest of the new Democratic majority of Congress. In the prepared text of the speech, sent out by the White House some 40 minutes before Bush ascended the House rostrum, the president was to say... "I congratulate the Democratic majority." When Bush delivered the line, however, he paid tribute to the "Democrat majority."

Dropping the "ic"... was almost certainly a deliberate move by Bush... the phrase was a particular favorite of former Wisconsin Sen. Joseph McCarthy. A recent Washington Post column filled in the backstory: according to the Columbia Guide to Standard American English, McCarthy "sought by repeatedly calling it the Democrat party to deny it any possible benefit of the suggestion that it might also be democratic"

The phrase lay largely dormant for years, however, until President Bush resuscitated it during last fall's midterm election season and made it a mainstay of his public remarks about the opposition party. It has since been widely adopted by many Republican lawmakers, conservative political activists, and conservative commentators and pundits at media outlets like Fox News.

For all of Bush's talk tonight about crossing party lines to work with the new Democratic Congress, it is the missing two letters that may offer the clearest indication of whether partisan tensions are really like to fade in the waning years of Bush's presidency.

--Yochi J. Dreazen

From some of the professionals: Len Burman, Jason Furman, and Roberton Williams, "The President’s Health Insurance Proposal-—A First Look" (Washington DC: Tax Policy Center) http://www.urban.org/UploadedPDF/411412_firstlook.pdf

In some respects, the plan is very innovative and a step in the right direction.... The president’s plan effectively turns the tax subsidy for health insurance into a kind of voucher.... The proposal will almost certainly encourage some people who currently lack insurance, particularly middle-income families, to get it.... However... the subsidy will be more valuable for high-income people than for those with lower incomes who most need help. In fact, low-income households with no income tax liability would get virtually no help....

[T]he proposal would level the playing field between employer-sponsored insurance and insurance purchased in the individual market. The plan would lead some employers, especially small and medium- sized businesses, to stop offering health insurance to their employees, exacerbating a trend that is already well underway. Even if such employers increase wages by the amount of the firm’s previous contribution, this would fragment risk pooling and insurance, forcing some higher-risk people, especially those with low incomes, into the ranks of the uninsured....

The administration does propose to provide states with incentives to address the problems in the nongroup [individual] market, but those promises may not be backed by adequate funding to deal with the serious challenges facing those in the nongroup market. Moreover, the tax changes would go into effect regardless of whether or when states adopted the complementary changes to the nongroup market....

This brief paper summarizes the proposal based on information that we have available as of noon on January 23, 2007. (It will be updated if new information becomes available.)...

Greg Mankiw writes:

"a step in the right direction": That's how Leonard E. Burman, Jason Furman, and Roberton Williams describe the health care proposal that President Bush will propose in tonight's speech. So, yes, there is hope for bipartisanship.

I would have said that Burman, Furman, and Williams describe it as "in some respects... a step in the right direction." Let's give them the mike again:

The administration estimates that changes in the group and nongroup markets would, on net, reduce the number of uninsured by 5 million. Other models, such as that of MIT economist Jonathan Gruber, have generally assumed that substantially more employers would drop plans; those models would likely show only a small reduction—-or even an increase—-in the number of uninsured. In either case, the total effect masks an adverse change in the composition of the insured as the households that lose insurance tend to be poorer, sicker, or older and thus unable to purchase coverage in the individual market as it is now structured while the households that gain insurance tend to be richer, healthier, and younger.

The success of the proposal will depend critically on whether states come up with effective means of providing insurance for those with low incomes or health problems. The proposal’s details on this score are sketchy, but it appears to make no additional money available to aid pooling in the nongroup market—-it simply redistributes current subsidies....

Burman, Furman, and Williams would support the proposal if it were to be "substantially revised and expanded." The devil, as always in health care, is in the details.

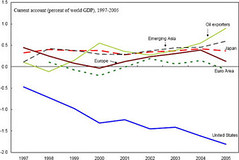

The regional course of trade deficits and surpluses: 1997-2005.

Source: IMF, via Global Economy Matters: Structural Drivers of Global Macroeconomic Imbalances.

The Situation:

Net capital inflow: $600B (from foreign central banks) + $200B (from foreign private wealthy) = $800B a year.

This must balance:

Trade deficit: $800B a year

What happens if the $600B of net capital flowing in from foreign central banks disappears?

- U.S. interest rates go up--supply and demand in the capital market for loanable funds.

- U.S. dollar's value goes down--supply and demand in the market for foreign exchange.

- A less-valuable dollar raises dollar-value exports and lowers dollar-value imports.

- Higher interest rates pull in more capital, which partially offsets the decline in foreign central bank-driven inflow.

- U.S. has to move people from construction and consumer goods to export and import-competing goods. (8M?)

- Foreigners have to move people from export industry into construction and consumer goods. (40M?)

Why can't the current configuration go on forever? Consider China, currently at $250B a year (12% of Chinese GDP) with foreign exchange reserves of $1T (50% of Chinese GDP). In a decade, at the current pace, foreign exchange reserves of $4.5T (110% of future Chinese GDP). Losses on foreign exchange reserve portfolio: to buy dollars at $1=8RMB and then to sell them at $1=16RMB is expensive.

- What happens just before foreign central banks abandon their dollar-purchase programs?

- What happens just before that?

- And just before that?

http://delong.typepad.com/teaching_spring_2006/2007/01/in_condemnation.html

The regional course of trade deficits and surpluses: 1997-2005.

Source: IMF, via Global Economy Matters: Structural Drivers of Global Macroeconomic Imbalances.

The Situation:

Net capital inflow: $600B (from foreign central banks) + $200B (from foreign private wealthy) = $800B a year.

This must balance:

Trade deficit: $800B a year

What happens if the $600B of net capital flowing in from foreign central banks disappears?

- U.S. interest rates go up--supply and demand in the capital market for loanable funds.

- U.S. dollar's value goes down--supply and demand in the market for foreign exchange.

- A less-valuable dollar raises dollar-value exports and lowers dollar-value imports.

- Higher interest rates pull in more capital, which partially offsets the decline in foreign central bank-driven inflow.

- U.S. has to move people from construction and consumer goods to export and import-competing goods. (8M?)

- Foreigners have to move people from export industry into construction and consumer goods. (40M?)

Why can't the current configuration go on forever? Consider China, currently at $250B a year (12% of Chinese GDP) with foreign exchange reserves of $1T (50% of Chinese GDP). In a decade, at the current pace, foreign exchange reserves of $4.5T (110% of future Chinese GDP). Losses on foreign exchange reserve portfolio: to buy dollars at $1=8RMB and then to sell them at $1=16RMB is expensive.

- What happens just before foreign central banks abandon their dollar-purchase programs?

- What happens just before that?

- And just before that?

http://delong.typepad.com/teaching_spring_2006/2007/01/in_condemnation.html

Barry Ritholtz:

Apprenticed Investor: Know Thyself: Statistical evidence suggests a high probability that you underperformed the broader market last year, and most investors will likely underperform again this year. But it's not just retail investors. The pros are barely any better. In fact, four out of five investors will do worse than the S&P 500 this year.

The problem, it seems, is a design flaw.

Indeed, many classic investor errors -- overtrading, groupthink, panic selling, marrying positions (i.e., refusing to sell), chasing stocks, rationalizing, freezing up -- are mostly due to our genetic makeup. Humans have evolved to survive in a harsh, competitive landscape. To do well in the capital markets, on the other hand, requires a skill set that is very often the antithesis of those innate survival instincts.

Why is that? The problems lay primarily in our large mammalian brains. It is actually better at some things than you may realize, but (unfortunately) much worse at many others you are unaware of. Most people are unaware they even have these (for lack of a better word) "defects." The fact is, when it comes to investing, humans just ain't built for it.... Humans have a tendency to see order in randomness. We find patterns where none exist. While that trait might have helped a baby recognize its parents (thereby improving the odds for its survival), seeing patterns where none exist is counter-productive when it comes to investing.

We also selectively perceive data, hoping to find something that confirms our prior views. We ignore data that contradicts those prior views. We even reinterpret old evidence so it is more in sync with our perspective. Then, we only selectively remember those things that support our case. Last, we overuse Heuristics, which is defined as simple, efficient rules of thumb that have been proposed to explain how people make decisions, come to judgments and solve problems, typically when facing complex problems or incomplete information (call them mental short cuts). These short cuts often generate "systematic errors" or blind spots in our analytical reasoning.

And that's only a partial list of analytical imperfections you have inherited....

Most investors are overconfident to a fault. Don't believe me? Consider the following anecdote: A man was terrified to fly, yet thought nothing of roaring down the street -- sans helmet, no less -- on his Harley. That reveals a high degree of confidence in his own skills vs. a highly trained pilot's. That's some risk-analysis engine you got there, bub. That blind faith in our own abilities may have come in handy on mammoth hunts, but it is hardly beneficial when to comes to picking stocks.... The natural reactions to discomfort or threat -- coupled with a natural inability to be patient -- doesn't serve us well in the market. During market bottoms, most of the herd is selling. To buy during periods of intense selling means leaving the safety of the crowd, standing out, risking humiliation....

Most investors -- the 80% who underperform -- would probably be better off going the index route. If you're still interested in trying to outperform -- despite all we discussed today -- then I admire your gumption.

As somebody I was talking to last week said of their friends who went into the hedge fund industry two years ago: "They're very smart, they work like dogs, and they trailed the S&P by 3 percentage points last year."

On Botswana's success:

Global Development: Views from the Center: Can other countries replicate Botswana's past? (Can Botswana?): Posted by Michael Clemens at 03:45 PM: Botswana's president, Festus Mogae, held a private luncheon at CGD on Wednesday. (In a triumph of protocol, the president was allowed to serve himself first from our modest buffet.) After that he gave a well-attended public speech. In both forums, the discussion revolved around three questions. The first looked to Botswana's past, addressing the replicability of Botswana's spectacular rise elsewhere; the other two looked forward, asking whether Botswana can sustain its own miracle.

How did Botswana avoid 'resource curse' and use its diamond revenue to spark sustained growth?The president noted that his predecessor, Seretse Khama, transferred rights to subsoil diamonds away from Khama's own tribe -- the Bangwato -- to the state. Crucially, Khama did this before the diamond revenues began to flood in; it is much easier to redistribute hypothetical income than actual income. President Mogae also mentioned the skill of the team that negotiated with De Beers, plus their prescient decision to reinvest some of their royalty revenue back into De Beers -- thus turning Botswana's diamonds into a triple payday of royalties (50%), corporate taxes, and dividends.

Economists have noted the importance of centuries-old political institutions in shaping the transparent governance that ensures those revenues really do end up in the Treasury. Both this and the president's above point about timing, unfortunately, call into question the simple replicability of a "Botswana model" elsewhere. The president said little to allay such doubts.

How has Botswana begun to turn the corner on the HIV/AIDS epidemic? President Mogae noted that Botswana has led Africa in its embrace of routine opt-out HIV testing. (On September 21st, the United States followed Botswana's lead.) Free condoms are universally available. Observers noted that from very early on Botswana has taken the epidemic seriously -- in stark contrast to its large neighbor to the south -- and currently provides antiretroviral therapy to almost all who need it. Today only 6% of births to HIV-positive Botswana mothers result in an HIV-positive baby.

Why are foreign investors still hesitating to enter Botswana? Botswana is small, semi-arid, and landlocked. Some of the same Taiwanese textile firms that went to Mauritius initially considered Botswana, but were dissuaded by high ground transportation costs to get products out. Recent efforts to privatize Air Botswana have been stymied by investors unwilling to put their money into Botswana and especially into airlines.But there are ways out. Botswana has lower corporate taxes, less bureaucracy, and a better-educated workforce than South Africa, and has publicly assumed much of the HIV treatment burden (so employers won't have to).

It also boasts political stability, accountable democracy, and a very high-quality infrastructure, especially in telecommunications. Several around the lunch table urged the president to leverage these rare advantages by attracting investors, particularly American investors, in the information sector.He agreed this was a priority, and noted his country's efforts to lessen Botswana's isolation by pushing for the SADC free trade zone (.pdf) and by participation in the Eastern and Western Africa Submarine Cable initiatives. Recent trade preferences established under African Growth and Opportunity Act might also help bring investors in.

President Mogae noted that he had to fight for two years to get Botswana included in the original 2000 list of AGOA-eligible countries, over resistance due to the country's high per-capita income. He is currently pushing for Botswana to be made eligible for funding from the Millennium Challenge Account, noting that his country meets all of the MCA selection criteria except income per capita.

Ummm... Robin... Robin Toner's lead should have been: "Vice President Cheney tries to blow up Treasury Secretary Paulson's attempts to patch together a legislative deal on Social Security." It wasn't.

Robin Toner writes that hopes for Social Security reform are "fragile," and that "few other issues so clearly highlight the limits of bipartisanship these days, the mistrust and ideological division just barely below the surface.... It is, in short, a polarized debate, and likely to become all the more so..."

To back this up, we have:

People of both parties looking for a bipartisan deal: Senators Conrad, Baucus, and Gregg; Representatives Rangel and McCrery; Treasury Secretary Paulson; Assistant Treasury Secretary Davis.

Democrats afraid that Bush's pledges to negotiate in good faith are false: Senators Conrad and Baucus; Representative Emmanuel.

Democrats declaring that compromise with Republicans is unwise and unnecessary: "Brad Woodhouse of Americans United for Change, a liberal labor-backed organization."

Republicans declaring that compromise with Democrats is unnecessary: Vice President Richard Cheney, and Grover Norquist.

The people Robin Toner finds who aren't looking for a deal in the middle are named Cheney, Norquist, and Woodhouse. I guess it's fair to call this "polarized": Brad Woodhouse's standing and influence in the Democratic Party are about equal to the sum of Richard Cheney's and Grover Norquist's standing and influence in the Republican Party, after all.

Why oh why can't we have a better press corps?

Here's the story:

Fragile Hopes for Bipartisan Rescue of Social Security - New York Times: Social Security... few other issues so clearly highlight the limits of bipartisanship... mistrust and ideological division.... [A]ny fix -- which would be likely to involve a politically risky mix of benefit reductions, tax hikes or other painful changes -- will require broad and deep bipartisan support.

"The American people have to sense on these types of issues that it'a absolutely bipartisan and that the agreement was reached in an absolutely fair way," said Senator Judd Gregg, Republican of New Hampshire, the senior Republican on the Budget Committee.... Efforts have been made: Treasury Secretary Henry M. Paulsen Jr. has talked to crucial lawmakers, including Representative Charles B. Rangel of New York, the chairman of the Ways and Means Committee, "encouraging everyone to bring all their ideas to the table, and hoping that some kind of consensus can emerge," as Michele Davis, the assistant Treasury secretary, puts it. Mr. Rangel said he had also been talking about the possibility of action on Social Security with the ranking Republican... Jim McCrery.... Gregg and Senator Kent Conrad... a bipartisan working group....

But... Vice President Dick Cheney... said Mr. Paulsen's openness to all ideas did not indicate that the administration was open to any increase in the payroll tax.... "[N]othing's changed," Mr. Cheney said.... Conrad said that after those comments, his effort to move forward with his working group “is on life support.... People have interpreted that to mean that the administration is not willing to alter their position one iota.”... Rahm Emanuel... said that... it was all the more important “not to take away the one solid cornerstone of their retirement.” He added, “It’s not good politics and it’s not good economics.”

Senator Max Baucus of Montana... said... “I’m more than open, if the president is truly willing to look at all options.”...

[A] polarized debate, and likely to become all the more so.... [A]dvocacy groups are watching.... Grover Norquist... making a pre-emptive case against any payroll tax increase, although he had been assured by the president in December that he would hold the line.... “There is no reason for us, as a campaign working on this issue, and there’s no reason for the Democrats to compromise with this president on the most sacrosanct program to progressives after he lost the privatization debate and lost the election,” said Brad Woodhouse of Americans United for Change, a liberal labor-backed organization.

Monday, January 22, 2007

Thomas Ricks has some explaining to do, as it takes him less than twelve hours to perform a truly astonishing feat of journamalism. Compare and contrast:

(1) The lead from Thomas Ricks's article in Tuesday morning's Washington Post:

General May See Early Success in Iraq: The battle for Baghdad will start in mixed Sunni-Shiite neighborhoods chosen by military strategists as being the least likely to offer stiff resistance, raising the odds of early success, according to military planners and officials.... But that could be followed by a sharp increase in violence as insurgents learn U.S. and Iraqi tactics, military officials said....

[G]eneral [Petraeus], whose Senate confirmation hearing is scheduled for this morning, plans to send all 17,500 additional U.S. troops ordered by President Bush into Baghdad.... Anticipating an uneven performance by the Iraqi army, military planners are advocating using American force and funding quickly to establish early victories, both in improving security and showing economic progress.

Petraeus's appointment as the top U.S. commander comes at a key point in the war.... The general offered a harsh critique of U.S. mistakes in Iraq in written testimony submitted to the Senate yesterday, noting a range of ills that included poorly managed elections and inadequate reconstruction plans. Now, as military and political leaders tout Petraeus as the best man to salvage the Iraq effort, he is in the delicate position of wanting to show progress quickly without raising expectations too high. "This will be a difficult mission and time is not on our side," he states in the written testimony to the Senate Armed Services Committee...

(2) Thomas Ricks Monday morning on the Brian Lehrer show:

http://prairieweather.typepad.com/big_blue_stem/2007/01/thomas_ricks_on.html[W]hile [the Bush administration] called this "Maliki's plan," it's almost the opposite. It's "we're going to send troops into the middle of the city, double the American presence on the streets of Baghdad because we don't trust your army" [plan].... The US government still hopes for a reconciliation... some sort of political solution.... [P]olitically the Bush administration consistently has been about 6 to 12 months behind the curve in Iraq from the very get-go.... The reality of Iraq that they haven't caught up with, I fear, is that the Shiites have concluded that they've won.... All we're doing is being a useful tool to help them out and keep the Sunnis off their back while they consolidate their hold....

The Iraqi prime minister saying he's dropping his protection of Muqtada al Sadr is like the third-base coach of the Yankees' single A farm team saying he's going to straighten out George Steinbrenner! That's the power relationship between Maliki and Sadr. Sadr commands a more powerful force than Maliki does. By US military calculations, Sadr's militia, the Mahdi Army, has more effective fighters than the Iraqi army does.... [T]wo aspects have characterized the American approach in Iraq over the past three years. One has been official over-optimism in which institutions fail to recognize the basic reality on the ground. The second is a rush to failure with Iraqi forces.... [T]he concern of a lot of people... especially officers who have a tour or two in Iraq is that the new plan combines both those flaws: official optimism about what Iraqis are willing to do, and a rush to failure in pushing Iraqis too soon to do too much....

Petraeus is a fascinating character. Just about the best general in the Army in a lot of people's view.... [H]e had a very successful first tour in Iraq in 2003-2004.... The other division commanders were digging themselves a pretty deep hole. Petraeus realized very quickly that US military training doctrine didn't really do the job.... He had the 101st Airborne Division up in Mosul and was quite successful.... [T]he bottom line on Petraeus with a lot of officers now is "look -- this situation is pretty bad, it's pretty bleak out there -- if anyone can do it Petraeus is probably the guy who can try best." But even then, what I'm hearing, is they don't expect it to succeed...

Either Ricks is misleading his radio listeners by allowing Brian Lehrer to goad him into portraying an excessively negative picture of the situation in Iraq, or he is misleading his Washington Post readers--on page A1--by letting his editors hornswoggle him into painting an excessively positive picture of the situation in Iraq.

We'll know which it is in three years, when he releases his next book. My betting is that the straight poop is on the radio, and the bulls--- is in the Post.

As I've said, I don't see it lasting a decade.

A correspondent points me to Jonah Goldberg's unsuccessful and pathetic attempt to pass himself off as a Star Trek geek:

Jonah Goldberg on National Review Online: I referred to the Gamesters of Triskellion, a famous episode where a bunch of day-glow super-brains-under-glass capture aliens from across the galaxy (the sector, really) and pit them against one another in gladiatorial bouts (I thought it'd be cool if presidential candidates did the same thing). The brains (send more brains...), or rather the "Gamesters," bet vast sums on who will win and how, etc. But for the life of me, I couldn't remember what the name of their currency was. I could remember what it sounded like, but I couldn't be sure. So, I wrote "I wager ten thousand credits that..."

Literally, within five minutes of posting the column, five people e-mailed me saying, "It's not credits, you bonehead! It's "quatlooms"! So, I made my Webmaster put down his copy of Juggs and change it to "quatlooms." At this time I would like to point out that many of these readers -- of whom I am quite proud -- could probably use a tan. Anyway, we changed it, and over the course of the next twenty four hours I got probably two dozen e-mails from people saying, "No, no, no! It's kwatloos." Or, "Good lord, man, don't you know anything? It's Quatloos." You see the subtle distinctions?

He is not of the body! Somebody call Landru!

A statement:

iran emrooz | first page : We the Undersigned Iranians :

Notwithstanding our diverse views on the Israeli-Palestinian conflict;

Considering that the Nazi's coldly planned %u201CFinal Solution%u201D and their ensuing campaign of genocide against Jews and other minorities during WWII constitute undeniable historical facts;

Deploring that the denial of these unspeakable crimes has become a propaganda tool that the Islamic Republic of Iran is using to further its own agendas;

Noting that the new brand of anti-Semitism prevalent in the Middle East today is rooted in European ideological doctrines of the nineteenth and twentieth centuries, and has no precedent in Iran's history;

Emphasizing that this is not the first time that the government of the Islamic Republic of Iran has resorted to the denial and distortion of historical facts;

Recalling that this government has refused to acknowledge, among other things, its mass execution of its own citizens in 1988, when thousands of political prisoners, previously sentenced to prison terms, were secretly executed because of their beliefs;

Strongly condemn the Holocaust Conference sponsored by the Government of the Islamic Republic of Iran in Tehran on December 11-12, 2006, and its attempt to falsify history;

Pay homage to the memory of the millions of Jewish and non-Jewish victims of the Holocaust, and express our empathy for the survivors of this immense tragedy as well as all other victims of crimes against humanity across the world.

Berkeley Letters and Science Faculty Forum. January 22, 2007. I always have problems understanding what John Campbell http://www.amazon.com/exec/obidos/asin/0199243816/braddelong00 is saying. He says that he is saying:

- There is an important and unbridgeable gulf between our notions of physical causation and our notions of psychological causation.

- Martian physicists--intelligences vast, cool, and unsympathetic with no notions of human psychology or psychological causation--could not understand why, could not put their finger on physical variables and factors explaining why, the fifty or so of us assemble in the Seaborg Room Monday at lunch time during the spring semester.

He says that he is not saying any of:

- The universe has a dual nature, in which mind is different from not-mind.

- Reductionism is wrong because there are important emergent properties of complicated systems, and reductionist and holistic explanations are quantitatively different.

- There is an important and unbridgeable gulf between understanding based on physical laws and understanding based on human empathy. Instead, Campbell says, there is only one kind of understanding and explanation, but it is applied to different sets of causal factors in different circumstances.

The word "supervenience" was not mentioned by anybody.

I had two questions for him. I think I would have understood him if I could have understood the answers to either of them:

If I were a member of a team of tentacled Martian physicists (don't get me started on the image of mollusc-like Martians living on an essentially desert planet), my physical-description model of Berkeley would include a model of Assistant Dean Chuck Stroup's brain at the subatomic level. I would then be able to say: "Aha! Suppose we were to decrease the levels of serotonin in the particular half-cubic-foot of space that is Chuck Stroup's brain; then the email messages containing the string "L&S Faculty Forum today" don't get sent, and we don't assemble here for lunch. Wouldn't that be a way for Martian physicists with no concept of human psychology to begin to understand why we are all here in the Seaborg Room right now?

Let me roughly quote from a lecture from a course, Physics 140, that I took as a junior from Ed Purcell: "How about the lithium atom? We can't calculate the joint orbitals of all three electrons--that's too hard. But we can get an approximate solution for the valence electron. It wants to be in the ground state, but the Pauli Exclusion Principle forbids it. So we can model the orbital of the third, valence electron as a single electron moving in the field of the nucleus partially shielded by the other two electrons in the next stable energy level above the ground state. The Schrodinger equation is... [Purcell starts doing math.]" Here we have a mixture of physical and psychological causation. The physical causation--the math driven by the physical laws of quantum mechanics--comes at the end. Before that comes psychological causation: Purcell attributes human-like intelligence to the electron that has desires and needs and to the brooding overall universal presence that is the Pauli Exclusion Principle, and so reduces the physical-causation problem to a simpler one that is approximately right and that he can solve. The resort to psychological causation is a way to get an answer even though the math for the three-electron problem is beyond our grasp. What is the difference between Ed Purcell's use of psychological causation here and your use of psychological causation as a factor in addition to serotonin levels in understanding human psychological depression?

But alas! I did not understand his answers--although I have no doubt that he did.

I can't help but think that the rhetorical trope of "Martian physicists" is a problem here. I take it for granted that "Martian physicists" have models of human brains at a subatomic level and understand the dynamic evolution of brain states and the connection of brain states to human actions, and do so at a level that makes "psychology" needless save as a shorthand way of dividing brain states into categories. Philosophers' "Martian physicists" don't seem to be able to do that.

He says:

Yad Vashem Council Chair slams settlers for abusing Palestinians - Haaretz - Israel News: The head of the council of the Yad Vashem Holocaust memorial on Saturday assailed Jewish settlers who harass Palestinians in the West Bank city of Hebron, saying the abuse recalled the anti-Semitism of pre-World War Two Europe.

The rest of the staff of the Yad Vashem Memorial Center, not so much:

A Yad Vashem spokeswoman told Haaretz that Yad Vashem Council Chairman Yosef (Tommy) Lapid's comments do not reflect the memorial center's position.

The story goes on: